The Majority of American Still View Homeownership as the American Dream

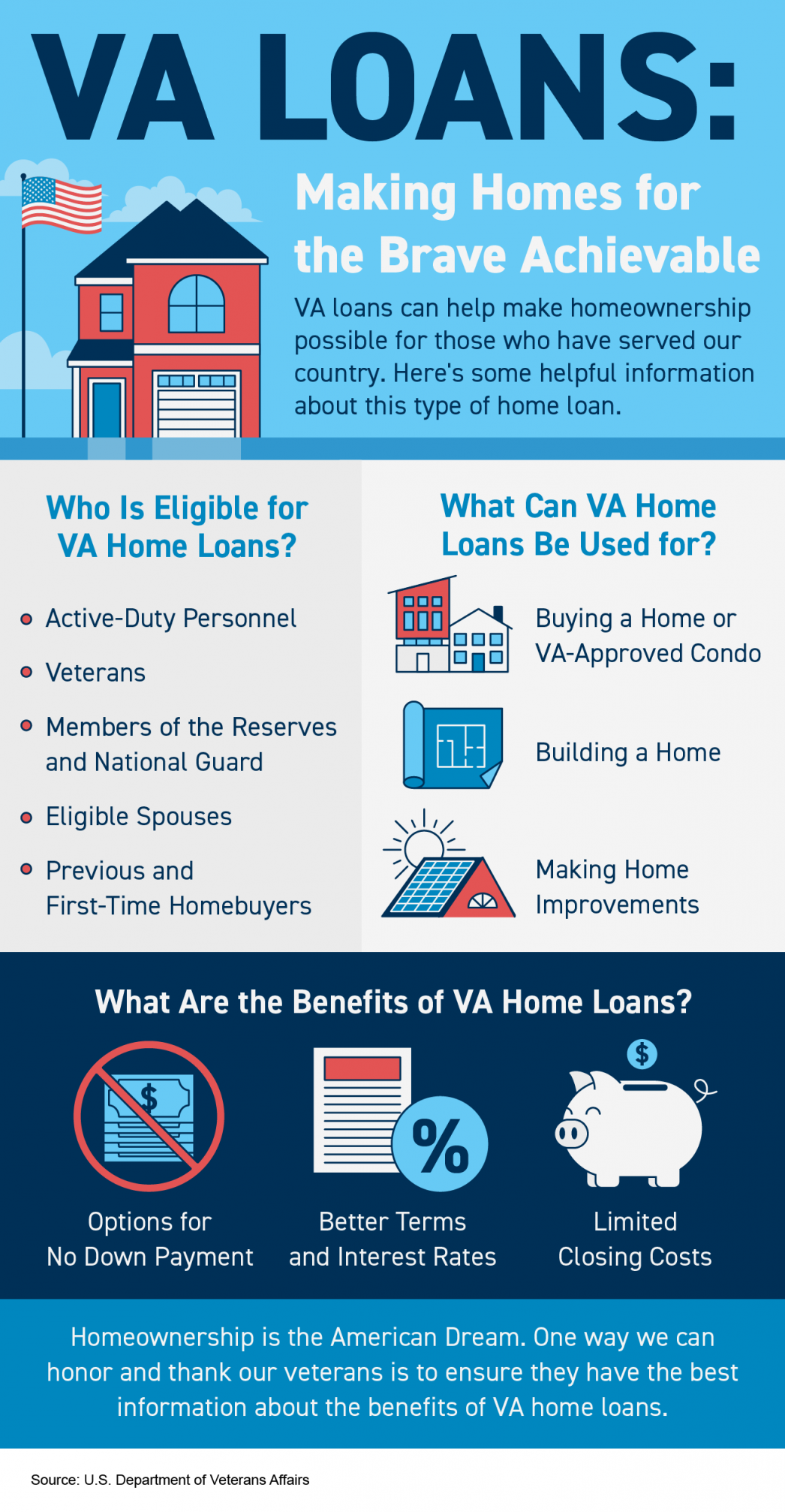

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view homeownership as a key life achievement. Let’s explore just a few of the reasons why so many Americans continue to value homeownership. The Financial Benefits of Owning a Home One possible reason homeownership is viewed so highly is because owning a home is a significant wealth-building tool, and it provides meaningful financial stability over renting by locking in your monthly housing payments for the length of your home loan. An article from Forbes explains: “Understanding the potential benefits of homeownership helps individuals see the value of owning property instead of renting. . . . household wealth among homeowners is a whopping 1,469% higher on average compared to renters, excluding home equity, making the allure of homeownership even more enticing.” Over time, owning a home not only helps boost your own net worth, but it also sets future generations up for success as you pass that wealth down. That may be why the Mynd report also says: “Most Americans (78%) still associate homeownership with the ‘American dream.’ And nearly two-thirds of Americans (65%) see homeownership as a means of building intergenerational wealth.” The Non-Financial Benefits of Homeownership While the financial benefits of owning a home are important, becoming a homeowner impacts you on a social and emotional level, too. As Mark Fleming, Chief Economist for First American, says: “. . . buying a home is not just a financial decision. It's also a lifestyle decision.” Your home provides feelings of achievement, responsibility, and more. 3by30 highlights the top 10 benefits homeowners enjoy. A few non-financial advantages include: Providing you with more freedom and control over your living space Giving you a greater sense of pride Helps with community engagement What Does That Mean for You? If your definition of the American Dream involves greater freedom and prosperity, then homeownership could play a major role in helping you achieve that dream. While it may feel challenging to buy a home today as mortgage rates and home prices rise, if the time is right for you, know that there are incredible benefits waiting for you at the end of your journey. You’ll have a place you can grow your wealth, call your own, and feel most comfortable. Like the National Association of Realtors (NAR) says: “. . . research has consistently shown that homeownership is also associated with multiple economic and social benefits to individual homeowners. Homeownership has always been an important way to build wealth.” Bottom Line Buying a home is a powerful decision and a key part of the long-term dream for many Americans. And if homeownership is part of your dreams this year, let’s connect to start the process today.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn't Have to Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing homeownership as a way to build their wealth, but it may not be exactly the way previous generations have done it. The study explains how they’re breaking into the market: “. . . younger generations of Americans are not buying into that dream in the same way that older generations have. A growing number of Americans are choosing to make their first real estate purchase as an investment property.” Instead of buying a home and moving into it themselves, some young buyers are purchasing a home so they can use it as a rental. This tactic may be gaining popularity, at least in part, because of the affordability challenges brought about by today’s higher mortgage rates. The report above mentions how many people in this group are considering this approach. It says: “Almost half of Millennials and Gen Z (43%) are considering buying an investment property compared to only 9% of Baby Boomers and 27% of Gen X.” Why Younger Buyers Are Buying a Home To Use as a Rental This strategy allows buyers to continue living in their current location, like the bustle of a city apartment or a neighborhood that they know and love, where they couldn’t afford to buy. But instead of giving up on the idea of owning a home, they buy a home in a more affordable area with the intention of renting it out. In a way, they’re getting the best of both worlds. They live where they want, and they still own a home where they can afford it. Their goal is to generate passive income and diversify their assets. It works like this: in addition to having a rental stream of income, the equity they build in their house will also help grow their net worth over time. Bottom Line If you’re thinking about buying a home as an investment strategy to build your wealth, let’s connect to explore your options and nearby areas that may have homes that fit what you’re looking for.

3 Trends That Are Good News for Today’s Homebuyers

3 Trends That Are Good News for Today’s Homebuyers While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home. As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you when you go to buy a home today. 1. More Homes To Choose from During the pandemic, housing supply hit a record low at the same time buyer demand skyrocketed. This combination made it difficult to find a home because there just weren’t enough to meet buyer demand. According to Calculated Risk, the supply of homes for sale increased by 39.5% for the week ending October 28 compared to the same week last year. Even though it’s still a sellers’ market and supply is still lower than more normal levels, you have more to choose from in your home search. That makes finding your dream home a bit less difficult. 2. Bidding Wars Have Eased One of the top stories in real estate over the past two years was the intensity and frequency of bidding wars. But today, things are different. With more options, you’ll likely see less competition from other buyers looking for homes. According to the National Association of Realtors (NAR), the average number of offers on recently sold homes has declined. This September, the average was 2.5 offers per sale. In contrast, last September, the average was 3.7 offers per sale. If you tried to buy a house over the past two years, you probably experienced the bidding war frenzy firsthand and may have been outbid on several homes along the way. Now you have a chance to jump back into the market and enjoy searching for a home with less competition. 3. More Negotiation Power And when you have less competition, you also have more negotiating power as a buyer. Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But the latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving those contingencies is going down. As a buyer, this is good news. The appraisal and the inspection give you important information about the value and condition of the home you’re buying. And if something turns up in the inspection, you have more power today to renegotiate with the seller. A survey from realtor.com confirms more sellers are accepting offers that include contingencies today. According to that report, 95% of sellers said buyers requested a home inspection, and 67% negotiated with buyers on repairs as a result of the inspection findings. Bottom Line While buyers still face challenges today, they’re not necessarily the same ones you may have been up against just a year or so ago. If you were outbid or had trouble finding a home in the past, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today.

Categories

Recent Posts